Rough road to N10.8tr 2020 budget execution

The 2020 amended budget signed last Friday by President Muhammad Buhari may not be able to rev the economy back to life in the face of the current COVID-19 challenges, says the Organised Private Sector (OPS).

The OPS members, in their separate reactions to President Buhari’s assent of the revised Appropriation Bill, lamented it is coming in July, which is already gone past half the year, saying it can hardly impact the economy positively.

Commenting on the document which many Nigerians are looking up to reset their business strategies under a struggling economy, the Nigeria Employers Consultative Association (NECA) for instance, noted that Budget 2020 has already been amended to N10.8 trillion in the face of current realities due to global disruption caused by COVID-19 pandemic. It however, expressed misgiving that the budget indeed does not really have the capacity to bring the economy back to life with oil and gas still accounting for about 10 per cent of GDP, 50 per cent of government revenue and over 90 per cent of the nation’s export earnings.

Its Director General, Timothy Olawale, stated that for Nigeria to witness any meaningful growth during the year, the economy must be insulated from the shocks of oil prices by channeling resources to sectors such as mining, agriculture among others.

His words: “With the possibility of another recession looming around the corner, key parameters of the 2020 Budget and other macro-economic projections can only be achieved, if government can stimulate economic activities through implementation of policies that will reduce poverty and unemployment.”

In the same vein, the Director General of the Lagos Chamber of Commerce and Industry (LCCI), Muda Yusuf, said the prevailing economic conditions have caused severe disruptions and delays in many facets of the citizens’ national life.

“This has also affected the Federal Government’s budget leading to a review of its key assumptions,” he said.

He lamented that with the budget being signed halfway into the fiscal year, there’s no doubt that the real sector of the economy would suffer severe setback.

Though, he explained that one should acknowledge that exogenous factors were responsible for the delay this time, he however argued that its impact towards reviving the economy would be minimal.

Yusuf opined that there should be concerted effort and commitment from the government and the National Assembly to return to the January to December budget cycle.

“No doubt the timing of the budget assent will affect its implementation, especially the capital component. But we’re hopeful the situation will normalise from next fiscal year,” he added.

In his reaction, the Chairman of the Major Oil Marketers Association of Nigeria (MOMAN), Mr. Oyetunji Oyebanji, said he had expected the cut to be more drastic in the face of dwindling government revenue.

He noted that several Ministries, Departments and MDAs ought to have been merged and others scrapped, as duplication of functions in the public sector is gulping scarce resources.

Ouebanji lamented that most government officials and Agencies (MDAs) still engage in frivolous trips that are often tied to trainings and seminars that add no value to their day-to-day operations.

The MOMAN chief expressed fears that having already entered the seventh month of the year, a successful implementation of the budget could be a major challenge because oil earnings, a major source of revenue to the government, is at an all-time low, coupled with the effect of the coronavirus pandemic.

He stated: ‘‘With the year already running out, how many months do we have to generate revenue. I don’t know if it is realistic to say that the revised budget would be able to achieve much’’.

He advised that Federal Government to ensure a paradigm shift in the way it conducts its business by cutting off wastages and reducing the cost of governance, including the recent allocation of N1.23 as administrative charge to the Petroleum Products Pricing Regulatory Agency (PPPRA) in the new pricing template.

He said N1.23 multiplied by the billions of litres of petrol imported into the country is a huge amount for the agency.

However, Mallam Kurfi Garba, the Managing Director, APT Securities, queried the rationale behind the 20 per cent reduction in the budget when the revenue source dipped by more than 50 per cent.

“For me, I had expected the budget to address the real issue of the pandemic and to reduce it to the barest minimum.” The budget was initially designed based on economic framework that never envisaged the COVID-19 pandemic. But even in the face of the pandemic, I had expected government to take some drastic measures which it has not. Twenty per cent has been cut off from their previous budget, when your source of revenue has declined by more than 50 per cent and your budget is reduced by 20 per cent, what do you intend to do with that? Even before the COVID-19, N2.3 trillion deficit had already been envisaged as they tried to borrow that money. Is it still feasible to borrow that money? The budget has been reduced to 20 per cent and so the deficit will be much wider and we are signing the budget in July when half of the year has already gone.

I do not envisage they will even do 25 per cent of the budget when they are even proposing to present 2021 budget by September, honestly I cannot understand that.”

For his part, Professor of Capital Market and former Imo State Finance Commissioner, Uche Uwaleke, said that the budget benchmarks in terms of crude oil price and output reflected current realities.

“The capital allocations also reflect government priorities with Works and Housing getting the largest share. Other sectors that received increased attention include Power, Transport and Agriculture.

“Relatively speaking, Education and Health got larger allocations compared to last year. The Health sector in particular will also be the greatest beneficiary of COVID-19 intervention allocations”, he said.

Uwaleke, however, expressed worry that total capital allocation of about N2.3 trillion is less than allocation to debt service of nearly N3 trillion.

“This underscores the need to find a lasting solution to the huge debt burden currently facing the country.

“I also think the recurrent expenditure can be reduced especially that of the Ministry of Defense at over N700 billion. Another area requiring searchlight is the over N1 trillion service-wide votes with items like contingency of N15 billion, the same amount provided for in the 2019 budget.

“There is also a provision for ‘International Sporting competition’ of N5 billion when it is obvious that many of such competitions won’t be holding this year due to COVID-19.

“In all, I commend the Federal Ministry of Finance Budget and Planning for its effort in ensuring that the country’s disjointed budget cycle is normalised. What remains now is effective implementation of the budget in order to ensure that the economy does not experience any severe recession.

“To this end, the directive by the President to the Ministry of Finance to ensure that MDAs get at least 50 percent of their revised capital budget before the end of this month is highly commendable.

“If that happens, there is the likelihood that unlike previous years, the capital component of the 2020 budget could attain a substantial level of implementation”, Uwaleke explained.

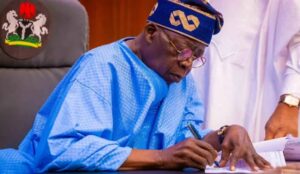

President Muhammadu Buhari on Friday signed into law, the revised N10.8 trillion budget for the year 2020 passed by the National Assembly in June. He said the budget had to be revised because of the effect of coronavirus on the nation’s economy. He said the ministries, departments and agencies will be given 50 percent of their capital allocation by the end of the month. The president submitted the initial 2020 budget to the national assembly in October 2019 and signed it into law in December 2019. Following the outbreak of the coronavirus, Buhari submitted a revised version of the budget to the National Assembly in May.

The original budget size when it was signed into law in December 2019 was N10.594 trillion. The initial adjustments made to the budget resulted in a N318 billion cut bringing the budget size to N10.276 trillion.

However, the Federal Executive Council at its May 13 meeting increased the total sum of the revised budget to N10.523 trillion, a difference of about N71.5 billion when compared to the approved budget. On June 11, the senate increased the total size of the revised budget by N5 billion from N10.805 trillion to N10.810 trillion. According to the Finance Minister, changes made to the budget include a revision of the daily crude oil production benchmark to 1.94 million from 2.18 million barrels per day. The exchange rate has also been adjusted from the initial N305/$.

While the development paves way for the implementation of the document, there are concerns over the source of funds to augment the shortfalls, especially in a time of a pandemic. There are also issues around priority misplacement. A breakdown of the budget shows that N2,488,789,433,344 was earmarked for capital expenditure, while recurrent non-debt expenditure has N4,942,269,241,984.

“If that happens, there is the likelihood that unlike previous years, the capital component of the 2020 budget could attain a substantial level of implementation”, Uwaleke explained.